ME MRS 706ME-EZ 2012-2025 free printable template

Show details

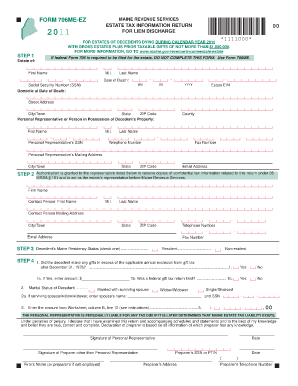

The following documents must be included with Form 706ME-EZ A copy of the decedent s will. A copy of the Certi cate of Discharge of Estate Tax Lien containing a description of the property. MAINE REVENUE SERVICES FORM 706ME-EZ ESTATE TAX INFORMATION RETURN FOR LIEN DISCHARGE 1211000 FOR ESTATES OF DECEDENTS DYING DURING CALENDAR YEAR 2012 WITH GROSS ESTATES PLUS ADJUSTED TAXABLE GIFTS OF NOT MORE THAN 1 000 000. If column B line 12 is more than 1 000 000 you cannot use Form 706ME-EZ you must...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign form 706me maine form

Edit your 706me maine form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your maine ez gross form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit maine estate discharge online

To use our professional PDF editor, follow these steps:

1

Check your account. In case you're new, it's time to start your free trial.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit non maine form. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

It's easier to work with documents with pdfFiller than you could have believed. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

ME MRS 706ME-EZ Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out maine return lien form

How to fill out ME MRS 706ME-EZ

01

Gather necessary personal information: Ensure you have your social security number, address, and any relevant income information.

02

Prepare tax documents: Collect all forms related to income, deductions, and credits.

03

Start the form: Begin filling out the ME MRS 706ME-EZ at the top, providing your name and contact information.

04

Report income: Enter details on your income from various sources as required in the form.

05

Claim deductions: Fill out sections for any applicable deductions you are eligible for.

06

Calculate your tax: Use the instructions included with the form to compute your total tax liability.

07

Review your information: Double-check all entries for accuracy and completeness.

08

Sign and date the form: Ensure that you sign the form before submission.

09

Submit the form: Send the completed ME MRS 706ME-EZ to the appropriate tax office as designated.

Who needs ME MRS 706ME-EZ?

01

Individuals with simple tax situations that qualify for the EZ form, typically those with lower income and fewer deductions.

02

New taxpayers looking for a straightforward way to file their state taxes.

03

People who are no longer itemizing their deductions and prefer to take the standard deduction.

Video instructions and help with filling out and completing maine housing

Instructions and Help about disclosure maine

Fill

706me maine form

: Try Risk Free

People Also Ask about estate information return

How much taxes deducted from paycheck Maine?

Overview of Maine Taxes Maine has a progressive income tax system that features rates that range from 5.80% to 7.15%. The state has a high standard deduction that helps low- and middle-income Mainers at tax time. No Maine cities charge a local income tax.

How much is taken out of a paycheck for taxes in Maine?

Overview of Maine Taxes Maine has a progressive income tax system that features rates that range from 5.80% to 7.15%. The state has a high standard deduction that helps low- and middle-income Mainers at tax time. No Maine cities charge a local income tax.

What is the burden of Maine state tax?

Maine Tax Rates, Collections, and Burdens Maine also has a corporate income tax that ranges from 3.50 percent to 8.93 percent. Maine has a 5.50 percent state sales tax rate and does not levy any local sales taxes. Maine's tax system ranks 35rd overall on our 2023 State Business Tax Climate Index.

Will I get a tax refund if I made less than $10000?

If you earn less than $10,000 per year, you don't have to file a tax return. However, you won't receive an Earned-Income Tax Credit refund unless you do file.

How do I calculate taxes on my paycheck?

How do I calculate taxes from paycheck? Calculate the sum of all assessed taxes, including Social Security, Medicare and federal and state withholding information found on a W-4. Divide this number by the gross pay to determine the percentage of taxes taken out of a paycheck.

What is Maine source income?

¶16-515, Sourcing of Business Income All income derived from or connected with the carrying on of a trade or business within Maine is Maine-source income.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get 706me number form?

The pdfFiller premium subscription gives you access to a large library of fillable forms (over 25 million fillable templates) that you can download, fill out, print, and sign. In the library, you'll have no problem discovering state-specific estate information discharge and other forms. Find the template you want and tweak it with powerful editing tools.

Can I sign the maine revenue discharge electronically in Chrome?

Yes, you can. With pdfFiller, you not only get a feature-rich PDF editor and fillable form builder but a powerful e-signature solution that you can add directly to your Chrome browser. Using our extension, you can create your legally-binding eSignature by typing, drawing, or capturing a photo of your signature using your webcam. Choose whichever method you prefer and eSign your maine ez discharge form in minutes.

How do I complete form 706me ez on an iOS device?

Download and install the pdfFiller iOS app. Then, launch the app and log in or create an account to have access to all of the editing tools of the solution. Upload your maine form discharge printable from your device or cloud storage to open it, or input the document URL. After filling out all of the essential areas in the document and eSigning it (if necessary), you may save it or share it with others.

What is ME MRS 706ME-EZ?

ME MRS 706ME-EZ is a simplified estate tax return form used in the state of Maine for reporting the estate tax liabilities of decedents with smaller estates.

Who is required to file ME MRS 706ME-EZ?

The executor or personal representative of an estate in Maine is required to file ME MRS 706ME-EZ if the gross estate exceeds the threshold set by Maine law for estate tax.

How to fill out ME MRS 706ME-EZ?

To fill out ME MRS 706ME-EZ, ensure accurate reporting of the decedent's assets, liabilities, and deductions by following the form's instructions carefully and providing all required information.

What is the purpose of ME MRS 706ME-EZ?

The purpose of ME MRS 706ME-EZ is to streamline the filing process for small estates in Maine while ensuring compliance with the state's estate tax laws.

What information must be reported on ME MRS 706ME-EZ?

The information that must be reported on ME MRS 706ME-EZ includes details about the decedent's assets, liabilities, exemptions, deductions, and any applicable tax credits.

Fill out your ME MRS 706ME-EZ online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Maine Estate Discharge Form is not the form you're looking for?Search for another form here.

Keywords relevant to form 706me maine

Related to 706me ez maine form

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.